how much taxes are taken out of paycheck in michigan

How much is 17 an hour after taxes. Normally the 153 rate is split half-and-half between employers and employees.

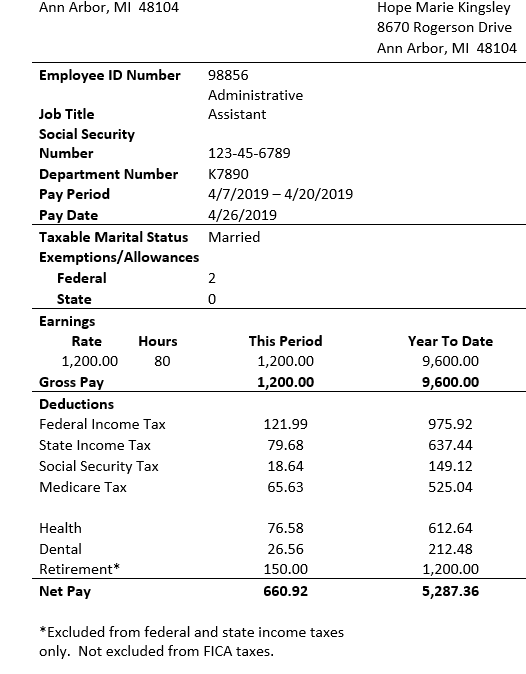

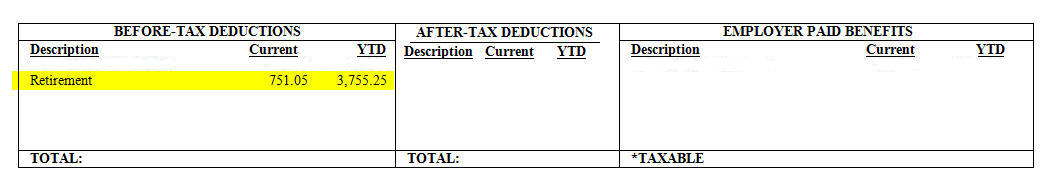

For The Federal And State Taxes The Retirement Is Chegg Com

If you save 30 of your earnings youll cover your small business and income taxes each quarter.

. This differs from some states which tax supplemental wages at a different rate. Does Michigan have personal income tax. Michigan has a flat income tax system which means that income earners of all levels pay the same rate.

What is 1200 after taxes. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. In this article youll find details on wage garnishment laws in Michigan with citations to statutes so you can learn more.

During the deferral period lasting through December 31 2020 this tax isnt taken out of the paychecks of employees at companies that have decided to participate in the deferral which is not mandatory. As an independent contractor if you made more than 400 you need to pay income tax and self-employment tax. How much is 15 an hour for 8 hours.

Take Home Pay for 2022. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. How is Michigan unemployment tax calculated.

This means that you get a full Federal tax calculation and clear understanding of how the figures are calculated. Generally around 15 is taken out of each paycheck and held for taxes social security and other fees. A paycheck calculator lets you know what amount of money will be reserved for taxes and what amount you will actually receive.

How much tax do I pay on 1100. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Our online Weekly tax calculator will automatically work out all your deductions based on your Weekly pay.

State and local tax withholding. Liability the tax rate is set by Michigan law at 27. If you arent supporting a spouse or child up to 60 of your earnings may be taken.

How much is tax usually. These are contributions that you make before any taxes are withheld from your paycheck. That works out to 800 per week 3200 per month and 41600 per year--pretax.

Lets say you got a new job that pays 20hour. How do I calculate how much tax is taken out of my paycheck. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal adjusted gross income.

As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. Income tax withholding rate. How much tax is withheld in Michigan.

Generally paycheck calculators will show the take-home salary for salaried and hourly workers. How Your Michigan Paycheck Works. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

We hope you found this salary example useful and now feel your can work out taxes on 45k salary if you did it would be great if you could share it and let others know about iCalculator. Use the paycheck calculator to see the Michigan taxes that. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425.

Overview of Michigan Taxes Gross Paycheck 3146 Federal Income 1532 482 State Income 507 159 Local Income 350 110 FICA and State Insurance Taxes 780 246. These amounts are paid by both employees and employers. Yes a flat income tax rate is levied on Michigan taxable income with additional local taxes in some cities.

This free easy to use payroll calculator will calculate your take home pay. We depend on word of mouth to help us grow and keep the US Tax Calculator free to use. The tax calculator provides a full step by step breakdown and analysis of each tax Medicare and social security calculation.

How much taxes do you pay on 700. 425 of taxable income. Normally 62 of an employees gross pay is taken out for this purpose and another 62 is paid by the employer.

These include the 62 for Social Security taxes and the 145 for Medicare taxes that your employer withholds from your earnings each pay period. Those with high income may also be subject to Additional Medicare tax which is 09 paid for only by the employee not the employer. So you wont get a tax withholding break from supplemental wages in Michigan.

The latter has a wage base limit of 147000 which means that after employees earn that much the tax is no longer deducted from their earnings for the rest of the year. How much taxes are taken out of a 1000 check. Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable.

How You Can Affect Your Michigan Paycheck. FICA taxes are commonly called the payroll tax. FICA taxes consist of Social Security and Medicare taxes.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. If youve had an on-the-books job before youre probably familiar with the basics of payroll taxes. The combined tax rate is 153.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. Paying taxes as a 1099 worker. What percent does taxes take out of my check.

What is a Paycheck Calculator. They can also help calculate the amount of overtime pay will be paid out directly in your check. However they dont include all taxes related to payroll.

What percentage is taken out of your paycheck for taxes in NC. An additional 5 may be taken if youre more than 12 weeks in arrears. Michigan residents are subject to a flat state income tax and some cities in Michigan impose an income tax.

How Much Money Gets Taken Out of Your Paycheck. Years of liability are based on the employers own history of benefit charges and taxable payroll Chargeable Benefits Component or CBC and a base rate. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent.

The self-employment tax rate is 153. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Look Out for Legal Changes.

Supports hourly salary income and multiple pay frequencies. That is one of the lowest rates for states with a flat tax.

Michigan Sales Tax Calculator Reverse Sales Dremployee

Michigan Income Tax Calculator Smartasset

Understanding Your Paycheck Human Resources University Of Michigan

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Calculator Take Home Pay Calculator

This Is The Ideal Salary You Need To Take Home 100k In Your State

Michigan Public Accountants Parents Who Took Advantage Of Child Tax Credit May See Smaller Refunds

Help Michigan W 4 Tax Information

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Average Taxes Taken Out Of Paycheck In Michigan Tax Walls

Michigan Estate Tax Everything You Need To Know Smartasset

Understanding Your Pay Statement Office Of Human Resources

Michigan Income Tax Calculator Smartasset

The Tax Cuts And Jobs Act Congressman Tim Walberg

Calculator Salary In Detroit Mi Comparably

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Free Michigan Payroll Calculator 2022 Mi Tax Rates Onpay

Pay Stub Payroll And Disbursements Western Michigan University